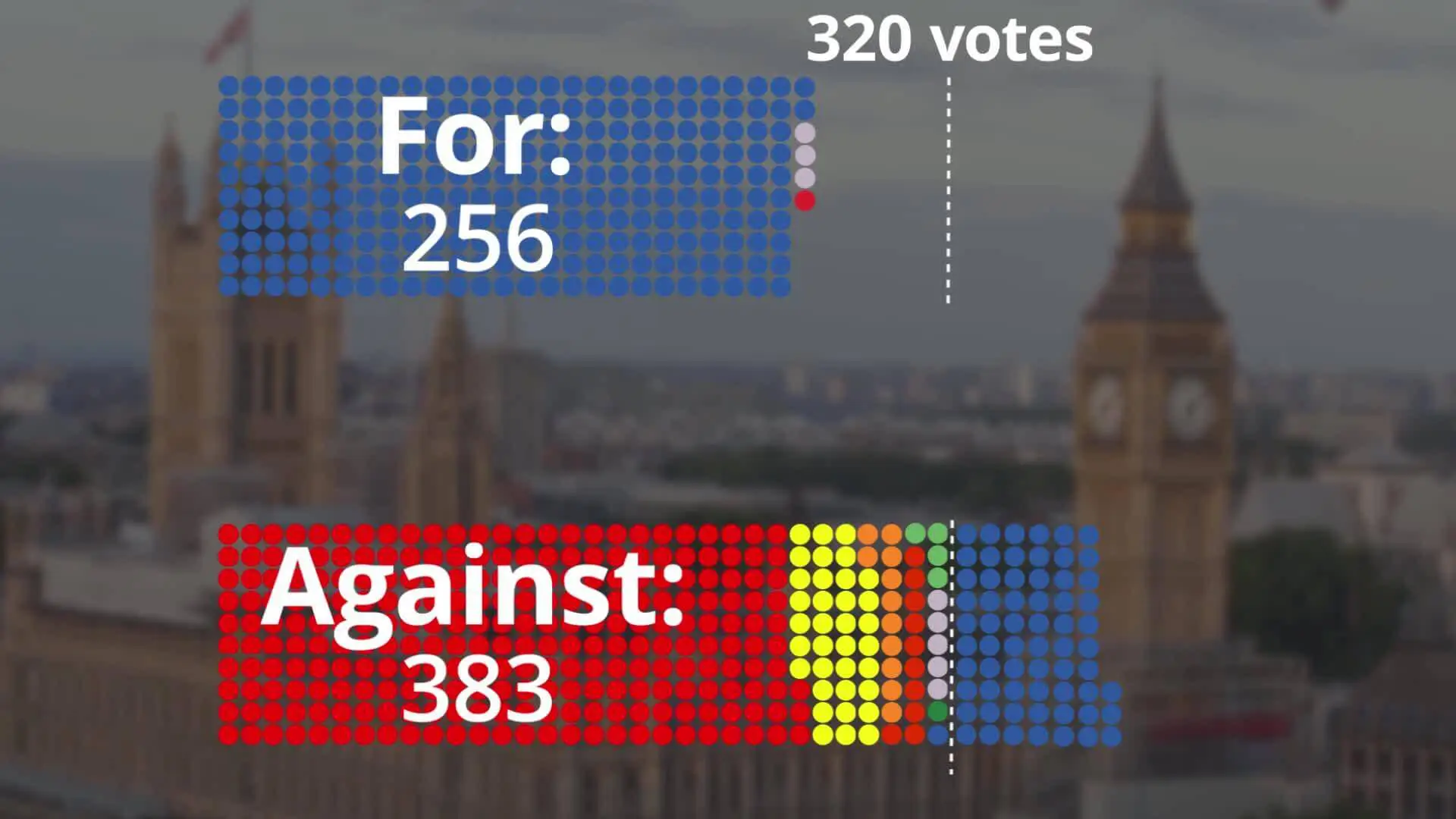

UK Prime Minister Theresa May suffered a humiliating and historic defeat on the Brexit deal in the House of Commons. Her deal was dismissed by the Member of Parliaments by 230 votes which is considered as the largest defeat suffered by a ruling government in UK’s history. 432 of the MP7s voted and out of them, 209 said ‘No’ to the deal. Earlier, May has postponed the voting from December to garner more support from the MP’s but despite that could not get them to vote for her Brexit Deal.

If the vote had been passed in the House of Commons, May had plans of making a departing from EU on Mar 29 and has also worked out on a transition period to thrash out details of a deal for free trade. Since the deal did not come through, now there is speculation about an early general election which could be another headache for Prime Minister May after Jeremy Corbyn has pressed for a no-confidence vote against the government.

Pound steadies but till when?

Despite May’s defeat in the exit vote, the Sterling has recovered, and that has taken the investors on a rollercoaster ride. The investors expected the Pound to slide down if May lost, but on the contrary, the Pound rebounded against the Dollar. Now that the ‘no-deal’ situation is highly probable with the huge defeat May has faced, the Pound is getting much support, and that is seen in the markets too. Even though the pound is steady for the time being, the future looks quite unstable as there is no telling about the outcome of the vote for ‘no-confidence.’ The Pound is expected to be stable for a short duration if Theresa May survives the vote of no-confidence. However, on the other hand, if she loses the pound can have a significant fall due to chances of a general election. The pound will remain volatile till the political situation stabilizes.

The GBP was at $1.284 against the dollar and was less by 0.1% and had regained a cent more than the lowest in the day after a huge margin defeated may. The trade funds that are focused on UK exchange are under tremendous pressure. The FTSE 100 ETF which a Tokyo based saw a decline of 1%, so were the shares in Asia-Pacific outside Japan. Shenzhen and Shanghai shares also saw a fall of 0.1%.